Tata Motors is setting up a car assembly plant overseas – in Venezuela – to penetrate the 4.5-million-unit South American market. Tata Motors has nine commercial vehicle (CV) plants overseas, but it has none for the passenger cars.

Tata Motors is setting up a car assembly plant overseas – in Venezuela – to penetrate the 4.5-million-unit South American market. Tata Motors has nine commercial vehicle (CV) plants overseas, but it has none for the passenger cars.

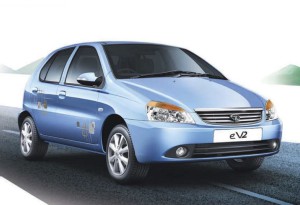

The Venezuelan plant, to be operated jointly with a partner, would initially assemble the Manza Sedan and Indica eV2 models from completely knocked down (CKD) kits exported from India, and later be expanded to manufacture other products, sources in the know told FE. While an announcement is likely by September, the assembly plant is expected to have an initial capacity of 20,000 units a year.

Confirming the development, a Tata Motors spokes-person said, “Yes, Tata Motors is setting up a plant in Venezuela to carry out full-scale assembly of passenger vehicles. We will make appropriate announcements when we are ready.”

Tata Motors’ latest move follows several other Indian automakers that have woken up to the vast opportunity in South America, which has annual sales of about 4.5 million cars. While the Venezuelan market fell 28% to 43,887 units in 2013, Brazil remains the biggest at 2.76 million units, followed by Argentina, Chile and Colombia. Local manufacturing is deemed necessary for any serious effort both because of the logistical challenges – huge distance from India – and because most countries in the continent, like Brazil, have rules to discourage exports and promote local production.

Gaurav Vangaal, analyst for light vehicle forecasting at his, said, “There are many India-made vehicles available in Latin American countries today and are also gaining popularity, but to add production at the site is a significant move. It will allow Tata Motors to expand its global presence to better penetrate the market, while understanding the local conditions well.”

Excluding subsidiaries like Tata-Daewoo’s South Korean CV operations and Jaguar Land Rover’s (JLR) plants in the UK and China, Tata Motors currently has nine overseas assembly plants, all of which are for CVs. In South Africa, Thailand, Bangladesh and Morocco, Tata Motors has its own subsidiary or operates through a joint venture, while in Myanmar, Ukraine and Senegal, a third party assembles for the company.

Tata Motors, which has seen passenger vehicle volumes slide for over two years – down 15% (to 3.14 lakh) in FY13, 37% (to 1.99 lakh) in FY14 and 37% in April-June FY15 to 33,157 units – is working hard on a revival strategy that has followed a thorough management restructuring. The process banks upon new launches that starts next month with the compact sedan Zest, while expanding sales overseas in markets like Australia, Indonesia and South America is expected to help it diversify risks from a single geography.

This strategy was put in place by ex-MD Karl Slym, who had joined the company in October 2012 but passed away earlier this year after an accident in Thailand. Tata Motors’ profits for FY14 rose 11% to R334.5 crore on the back of a strong performance by JLR, while revenues fell 23% to R34,288 crore.