Colossus of the aluminum and metals industry Alcoa is going to build a new additive manufacturing center with a $60 million price tag in Pittsburgh. Its purpose: To serve as the main production site as Alcoa begins developing a line of powdered metals made specifically for 3D-printing applications. What Alcoa’s new center represents, however, is a broader shift taking shape in the additive manufacturing industry.

Colossus of the aluminum and metals industry Alcoa is going to build a new additive manufacturing center with a $60 million price tag in Pittsburgh. Its purpose: To serve as the main production site as Alcoa begins developing a line of powdered metals made specifically for 3D-printing applications. What Alcoa’s new center represents, however, is a broader shift taking shape in the additive manufacturing industry.

More companies in a variety of sectors are interested in using 3D-printed metals for end-use parts. But when it comes to 3D printing in metals, there are currently two problems to surmount. One is the overall cost of not only the additive processes by which metal is printed, but also of the 3D printing machines and the support staff needed to run them. The other is the cost of the metal materials themselves and the lack of metal materials made specifically for 3D printing. Alcoa AA -0.80% is hoping to find solutions for both problems when its new additive manufacturing center opens, as Rod Heiple, the company’s director of R&D for engineered products and solutions, said during a call with Fortune.

“There are just a few materials available today that are usable within 3D printing of metals,” Heiple said. “A material developed as a feedstock for one additive process may not be, and in fact is unlikely to be, the optimal material for the next additive manufacturing process.”

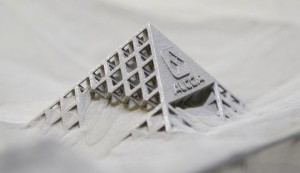

Today companies that produce metal parts via additive manufacturing processes are using powdered titanium, nickel, aluminum, and steel. Direct metal laser sintering is a common way for these powdered metals to come together to make solid objects. It’s how General Electric produced the fuel nozzles for its bestselling aircraft engine and Solid Concepts created a working firearm.

But optimizing powders for 3D printing is the challenge. Solving that challenge would not only mean a greater number of powdered metals for use in 3D printing, but also cheaper powdered metals. This is the sort of task for which Alcoa is well-suited. The company has nearly 100 years of experience in the atomizing process (the means by which a molten metal is converted into a powdered metal).

While the technology is fascinating in its own right, the business imperative is driving the research in cheaper powdered metals made specifically for 3D printing. Companies’ primary reasons for investing in additive manufacturing capabilities are the cost reductions that accompany collapsing the manufacturing supply chain. When GE, for example, chooses to invest $3.5 billion to purchase the 3D-printing machines that can produce metal parts and train the staff needed to run them, it’s not doing so because the technology is cool—it’s doing so because that’s where the additive manufacturing industry is headed.

A recent report from Stratasys Direct Manufacturing, the service arm of 3D-printing company Stratasys SSYS -0.22%, bears this out: More than 80% of 700 survey respondents from the manufacturing industry said further development of strong yet lightweight metals for additive manufacturing is what they want the most. In three years’ time, Stratasys Direct Manufacturing predicts use of metals in 3D printing to double.

Stratasys and 3D Systems DDD 0.81% , two titans of the 3D-printing sector, are keen to make inroads in metals printing as well. The increasing focus on what metals printing will do for the overall additive manufacturing industry—currently valued worldwide at $4.1 billion, according to the latest report from consulting firm Wohlers Associates—is the reason, for instance, Stratasys acquired Solid Concepts in 2014 and 3D Systems just established a partnership with the U.S. Army to develop 3D-printing materials for the automotive, medical, and aerospace industries.

The market for prototyping via 3D printing remains weak, but metals printing continues to grow at an impressive clip. More than just a new way for companies to make end-use parts, direct metal printing represents an area of revenue growth for an industry that has struggled to live up to the hype.

“The opportunity here is that these metals materials for additive manufacturing are low in number,” said Heiple, who couldn’t comment about the timeframe for when Alcoa’s new additive manufacturing center opens (although a company press release from September estimates sometime in the first quarter of 2016). “And the reason there’s an interest in metals is it all comes down to cost reduction, in end product and end solutions.”

In other words, there’s a growing movement of companies interested in crossing the chasm between 3D printing as a neat prototyping tool and 3D printing as a production tool on par with traditional manufacturing processes. To do that, they’ll need metals.