The sector of machining operations with laser beam is living a period of great and decisive innovations springing from several factors: the ever-increasing use of solid-state sources with 1 μm emission (fibre sources and disk laser), the growing diffusion of ultra-short pulse sources to operate effectively on several organic components; the use of more and more sophisticated and developed working systems, keeping clearly in mind the peculiarity of laser machining;…. In this rapidly evolving situation, it is difficult to collect precise data about the market of these machining processes and very arduous if we must analyse the sole European market that is still the cradle of these innovations. To answer the editorial staff’s demands, we have turned once more to our friend Arnold Mayer, manager of the Swiss Company Optech Consulting (www.optech-consulting.com), specialized in market researches in the photonics ambit.

THE WORLD MARKET

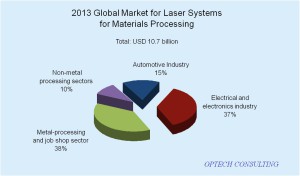

In 2013, the world market of laser systems for industrial applications reached the record volume of 10.7 billion dollars (see fig. 1), with the 5% increase in comparison with the previous year (editor’s note: analysing these figures, we must always pay utmost attention to the currency in which they are expresses and to the fact that this year the €/$ exchange has been very variable. For clarity, in fig.2 we report the same graph expressed in Euros). In conformity with the market analysis carried out by Dr. Mayer, the market for macro applications (which includes cutting, welding and marking applications) has grown by 7%, reaching a volume of 8.2 billion dollars, corresponding to 76.6% of the whole sector. This field has then scored a better trend than the machine tool one that has instead been affected by a 9% decrease in 2013. The reasons for this high percentage and this sale rise are manifold. The main one, in our opinion, is linked with the big diffusion of the use of solid-state sources with 1 μm emission in cutting applications (mainly) especially in the second 2013 semester, when it was proved that it was possible to overcome the limitations that these had in the cutting of alloyed steels with thicknesses slightly exceeding 7-8 mm approximately, and in welding ones (especially with the development of new techniques to operate on aluminium alloys, even of big thickness). Moreover, it is not negligible that this sector includes the Additive Manufacturing one, that is to say the implementation of prototypes or of small batches of metal objects (through deposition of metal powders melted by the laser beam, a machining that proves to be rapidly expanding in several advanced markets). It is also worth underlining the bigger and bigger diffusion of laser machining in Asian productive industries (China in particular, whose market for cutting applications only has recently surpassed the entire Europe’s, extended to Russia and Turkey).

The market of micro machining, with a sale volume amounting to 2.5 billion dollars (equal to the remaining 23.4%), registered in 2013 the 1% drop versus the previous year, in compliance with the reduced global investment demand in the area of semiconductors occurred worldwide but especially in the Asian market (micro laser machining are prevailingly used to manufacture semiconductors, solar cells, printed circuits and FPD flat displays). Besides, it is necessary to remind that Europe has scarcely contributed in the diffusion of these machining operations that have a good development only in North Europe Countries (Italy that, starting from the Eighties, had been the cradle where were developed several laser micro-machining processes (let us consider the development of laser applications in the gold sector where we were direct protagonist on behalf of an important company of Central Italy) has actually abandoned this sector that has been conquered by the several Asian laser enterprises). To provide a clear interpretation, we enclose in table 1 the classification of laser applications according to the subdivision between macro and micro proposed by Dr. Mayer.

Details about the single sectors

It can be interesting to examine the industrial sectors where in 2013 laser machining operations have been more applied. As we can see in the scheme of fig.3, the use in subcontracting centres is by far prevailing, considering the coupling both of metal machining and of the ones in the electric and electronic industry, applications that are both largely diffused in Europe (at present, prevailingly only the first ones in Italy). It is worth noticing that these applications have slightly grown in percentage in comparison with the previous year, exactly the opposite of what happened instead in the automotive sector, despite the big number of installations registered in Asia (China first of all). Another sector where a drop occurred in 2013 was the ambit of non-metal machining and this in spite of the big development achieved with ultra-short pulse sources in the field of solar cells and of photovoltaic devices. Finally, it is worth noticing the shrinkage in the sector of the components for the sun energy use field. This is due partly to the downturn of the important Chinese market and on the other hand to the reduction of tax benefits for users carried out by some European Governments (Germany and Italy, first of all). Concerning this, it can be interesting to analyse the graphs of fig.4 where we can see the evolution in time of the word sales of sole laser sources that, for a better understanding, are here subdivided into the two categories of fibre lasers (including also disk sources) and the other lasers, where the traditional CO2 sources are naturally comprised. These graphs can inspire some interesting remarks. The first is that, globally, in laser systems the source represents around 23% of the whole cost and this percentage turns out to be actually constant in time, even if over the years mechanical and electronic components have become more and more sophisticated, the second is given by the continuous increment in the use of fibre sources (where, as already said, also disk ones are included).

Tab. 1: GLOBAL 2013 MARKET FOR LASER MACHINING SYSTEMS

| MACRO applications | MICRO applications |

| 8.2 billion dollars | 2.5 billion dollars |

| For the following processes: | For the following machining: |

| Metal and non-metal cutting | Microlithography of semiconductors and LED |

| Drilling | Various typologies of FPD (LCD, OLED, PDP) |

| Welding of metals and plastics | PCB and Packaging of integrated circuits |

| Marking | Hybrid circuits and components |

| Additive Manufacturing | Solar cells |

| Surface treatments |

THE EUROPEAN MARKET

In 2013 the overall growth by 5% in comparison with the previous year of the world sales of laser systems for mechanical machining occurs after a long growth by over 10% of this market in the last 10 years (until the big crisis in 2008). This reduced growth was prevailingly caused by the demand shrinkage in the Pacific nations registered in the second half of 2013. This region, including China, Japan and Korea, nowadays consumes over 50% of the industrial laser systems produced in the world. The demand for these systems in Europe, assessed to be about 30% of the world total, instead increased by over 10% in comparison with the previous year. This increment was driven by the grown sales in Germany, France and Italy. This implied a drastic change versus 2012, when the laser market in Europe had been affected by the 8% decrease in comparison with 2011. Italy was a quite faithful mirror of this general trend, even if in this case the general variations were slightly mitigated in comparison with the mentioned values. The good European recovery in the course of 2013 was also given by the expansion of the sales in East Europe Countries where, for instance, they sold as many 2D sheet metal cutting systems as those registered in Italy (it is worth considering that this sale, in Countries like Poland, Czech Republic and Hungary occurred independently from the so-called relocation of companies coming from the Western world, as it happened in Romania and Bulgaria), and in Turkey (also thanks to the big number of local manufacturers that have purchased actually the same number of fibre sources as Italian producers’, place where this technology was actually born). All this took place also thanks to the use of European funds dedicated to the industrial development. Two of our recent visits to manufacturing industries of East Europe have confirmed us these results. We are presently living a time in which, on one hand there are the fallacious advocates according to whom the laser machining world has already reached and, in many case, surpassed a saturation level for years (situation, in our opinion, abundantly denied by the recent reality); on the other side, there is the whole world of the always indecisive people who wait for “the new solution” that never occurs in easy and immediately productive manner. Good done, in our opinion, by the companies that presented their innovations extemporaneously in secondary exhibitions of 2013 (a so-called “EMO year”) like BlechExpo in Stuttgart and Fabtech in Chicago, thus proposing their offer with the advantage of at least one year in comparison with their competitors.