On May 30th, at midnight, came officially into force the new provisions that, according to the Section 232, the United States Administration of Donald Trump has imposed on the import of steel and aluminium into the Country, with additional tariffs by 25 and by 10% respectively.

Roberto Carminati

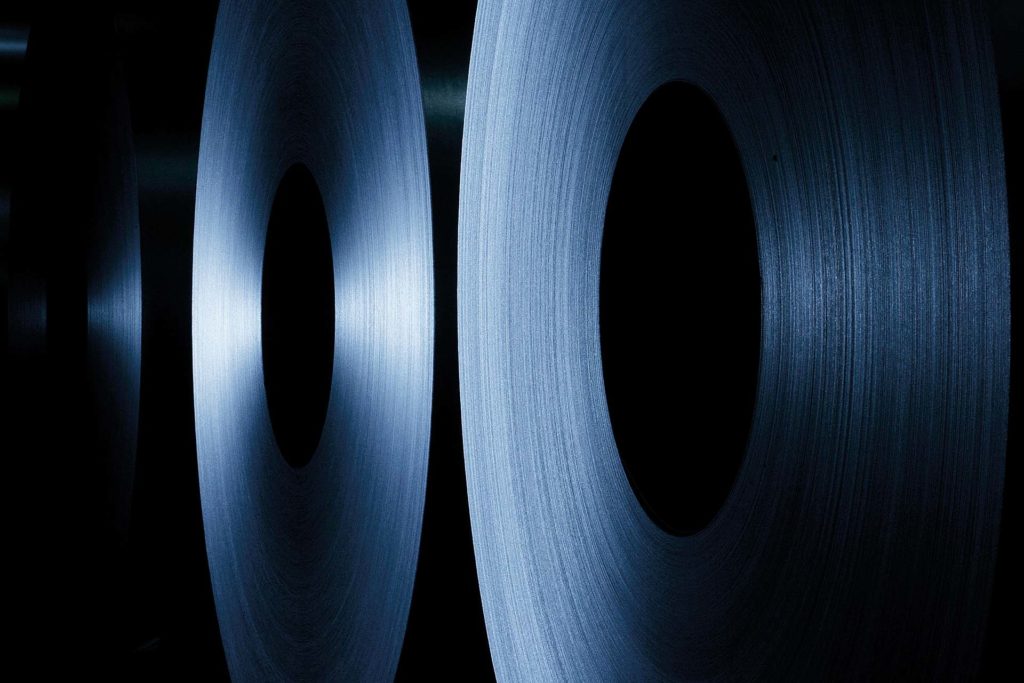

An action of «pure protectionism» that exerts a serious impact on «a very strict partner from the economic, geo-strategic and political point of view». With these words, the general manager of Eurofer, Axel Eggert, commented the events of what he defined «a very bad day for the global trade exchange system». On May 30th, the US Secretary of Commerce Wilbur Ross officialised in fact the launching of a measure much feared by international iron and steel contexts and especially by the European one. The latter, precisely represented by Eurofer, achieves an overall turnover amounting to 170 billion Euros and directly employs about 320,000 professionals in 500 plants. Since June 1st 2018, the sales of made in Europe steel and aluminium to USA will be charged with 25 and 10% customs duties respectively, as already feared previously. Identical measures are then likely to hit Mexico and Canada, other two nations until now spared by the duty war, oriented instead against China and Russia since the beginning. The White House has operated on the bases of the Section 232 of the Trade Expansion Act signed in 1962, which provides for having recourse to defensive instruments of this kind in the name of the national safety. The European Union, as personally underlined by Axel Eggert, is now called to implement defence policies towards a possible invasion of products previously directed towards Washington and then diverted towards «the biggest open iron and steel market in the world». The one of the Old Continent, precisely, where already in the first months of 2018 the customs duties applied by United States against other nations triggered a wave of purchases and a surge (+8.4%) of import from January to April. Canada (26%) and Europe (16%: Germany and Italy took part with a share, in the order, by 5 and by 2%) are the primary suppliers of steel and aluminium to the States, whose minor demand would create annual losses corresponding to 14 billion dollars.

Domino effect

Already in the recent past, Eurofer had brought up the problem of a steel import reduction beyond the Atlantic from the current 35 million tons yearly to 20-25 million tons. The economic value of the European export has been calculated in about 5 billion dollars and the customs duty incidence in one billion overall. Inferior, but not for this reason scarcely significant, is the aluminium weight in this context. The sales of this material to USA generate a business worth of 1.2 billion dollars, according to estimates by European Aluminium, reported also by other press sources. The concerns of Authorities in Brussels are then dominated by the need of stemming the possible rebound of materials from North America to the EU. Nevertheless, the real danger is a clamorous domino effect, making the companies damaged by the duty tariffs reduce domestic good purchases from their suppliers, national and non-. In other words, as it was noticed also elsewhere, a negative impact of customs duties on the German industry would result in a decrease of the sales of Italian steel and aluminium to Berlin. The overall continental supply chain of steel and aluminium would be damaged, definitively. «The strategy by Donald Trump is based on the acquisition of a strong negotiation instrument towards its trade partners– Alessandro Fossati, trader and expert in steel market from Ticino Gamma Trade Sa, told Lamiera without mincing his words–in order to renegotiate the existing treaties and to obtain more favourable conditions for his Country. Canada, Mexico and Europe had not come to terms until now and the tug-of-war had been successful with Brazil or Korea, but not with the others excluded from the customs duty exemption, that is to say Russia, Turkey and China». However, the Trump-politics is not worrying in itself whereas it is instead the European reaction.

Manufacturing and distribution at risk

«In a time of boost of the continental industry and manufacturing in genera l– highlighted Fossati – the availability of a bigger quantity of steel caused by American customs duties should be welcomed positively because able to improve the competitiveness of the European industry. On the contrary, it seems that the intention is reacting with the erection of other barriers, besides those already existing, also by non-US Countries». It is worth reminding that «despite the installed productive capacity of 240 million tons yearly of its plants and a consumption of 160 million, Europe cannot satisfy, in some products mainly intended for manufacturing, 100% of the domestic requirements and it is therefore physiological that it imports about 25% of the requirements». Rumour has it that, after having taxed the import of the eight million tons typically coming from China and Russia («freely purchasable until two years ago») the Union is going to defend further the European steel plants by limiting or hindering the import from Turkey, India and Korea. This would not represent a problem for steel industries, whose margins, on the contrary, would be enormously favoured. It would be damaging for the enterprises that use steel, for distribution channels, traders, ports and shipping companies. «Moreover, the risk is a further delocalization of the manufacturing of products with a high content of steel», stated Fossati.