Although it is early for a balance, we can already identify some signs that might influence the year-end results for the foundry industry. And they let us hope that 2013 may at least sanction the end of a period of great suffering. If already in 2011 and 2012 the balance of the Italian productive units had remained stable, in the first 2013 semester even an order increase included between 5 and 10% occurred. These signals are enhanced by some aspects connected with the trend of world macroeconomic dynamics, which seems to suggest a new economic expansion cycl

Although it is early for a balance, we can already identify some signs that might influence the year-end results for the foundry industry. And they let us hope that 2013 may at least sanction the end of a period of great suffering. If already in 2011 and 2012 the balance of the Italian productive units had remained stable, in the first 2013 semester even an order increase included between 5 and 10% occurred. These signals are enhanced by some aspects connected with the trend of world macroeconomic dynamics, which seems to suggest a new economic expansion cycl e.

e.

Seizing new opportunities is not however as simple as it might seem. As affirmed by the newly elected president of Assofond, Roberto Ariotti, who, during a recent convention, highlighted that the growth is more evident in the Countries that favour the development of the manufacturing system. This does not happen in Italy, yet, where there are still relevant improvement margins to increase the system competitiveness. Relying on its 227 member companies, which develop over 95% of the Italian production of iron castings and about 60% of non ferrous ones, Assofond (National Foundry Federation) triggers anyway a first sign of inversion trend; this is pointed out by the report Foundry in 2012 presented to the general ordinary meeting.

Macroeconomic focus

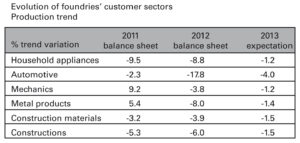

According to the analysis by Assofond, in 2012 the world GDP grew by 3.2% compared to 2011, against +3.9% of 2011 versus 2010. In 2012 Europe swallowed the 0.2% loss, with peaks by -2.1% in Italy. The general context is characterized by a weak demand, as well as the main macroeconomic indicators. Positive signs from the industrial production have been already perceived since October 2012 with a monthly variation by +0.2% in comparison with the third quarter. In Italy the situation is bleak: GDP closed at 2,013 billion dollars but the index of business confidence, in December, rose from -16.7% to -15.9%, in slight recovery versus the previous months. According to the expectations released by OCSE in September, the Italian GDP will keep on decreasing for the whole 2013, even if more slightly than in the first part of the year, with year-on-year rates by -0.4% in the third quarter and by -0.3% in the fourth. OCSE seems to suggest that the recovery announced for the second part of the year has not materialized, yet, and neither this will happen in the short term; therefore the goal of the crisis overcoming is delayed to 2014. The general survey affects then the foundry sector, in Italy too. The field weakness derives also from final markets’, where the building industry (also in most Europe) is still the sickest. And the same is true for mechanics. After +9.2% in 2011, in 2012 the production dropped by 3.8%, especially owing to the strong decrease of the home demand. Exports, although halving the growth rates compared to the previous year, have partly compensated for the local demand downturn, limiting to -3.5% the decline of the total turnover of the sector. In 2013 the production is expected to register still a reduction by 1.2%, to take then the growth course, mainly driven by exports, which also this year will rise on average by 3% in comparison with 2012. 2012 was a bleak year also for the market of metal products, as well as for the industrial production of household appliances, another key sector for foundry. The latter dropped by 18% in 2012, with a turnover reduction limited to the half compared to the production drop, thanks to the higher export stability compared to the diminished domestic consumptions.

Foundry in Italy and the industry of the future

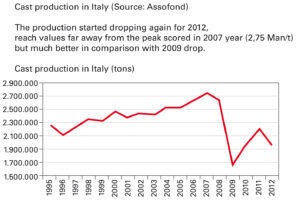

The Italian foundry industry is not however doing badly as we might expect. Assofond underlined that ferrous and non ferrous casting industries are 1,111, without relevant variations between 2011 and 2012. The number of employees has anyway decreased, with variations by 1.1% for ferrous metal foundries and by 2.9% for non-ferrous metal foundries, corresponding to 14,182 and 14,563 workers respectively. The produced tons are almost 2 millions, with values dropping by 11.5%. The turnover follows a similar trend: -9.0%, with an output value below 7 billion Euros. Although some ambits are slightly growing, in no case the production levels of 2008 were recovered: the percentage variations for iron castings, steel castings and micro castings were respectively by -33%, -22% and -16%.

In terms of production, the almost 120,000 tons less of cast iron in 2012 are subdivided between ductile iron castings, decreasing by 11.1%; and gray iron castings, with – 9.5%. A significant rise of carbon products is registered in steel castings with +18.4%, while alloyed and stainless steels are both decreasing. The weight of carbon steels on the total of the yearly production almost reaches the 2008 values (21.4%);while the production of non-ferrous castings has diminished by 13.7%. The two main metals, aluminium and zinc, respectively lose 13.9% and 10.9%. But what kind of industry should we expect for the future? Certainly, experts had crowned 2013 as the turning point year, but numbers might turn positive again in all economies only since 2014, with stronger growths in Bric nations (Brazil, Russia, India, China), excellent in USA, slight in the Eurozone. According to the estimates, the final situation in 2013 will be worse than expected but in 2014 reference markets will live a rise. Optimism does not fully permeate forecasts, but the end of the crisis is coming and the first signs are becoming relevant. The data by the European Eurfer Association about the steel industry agree with the forecast, suggesting that, among final markets, constructions (which absorb 33% of the total) will close 2014 with +1.2% against 2013, while automotive (second major consumer) will end at +2.4%. Specific remarks deserves just automotive, which will couple a structural growth driven by the constant rise of the world population with a further development element represented by the trend of creating lighter and lighter vehicles. It is an excellent opportunity for the industry of foundry products: it will involve new applications and investments in machinery, technologies and structures.