The evolution of diode laser price and performance is rapidly opening new markets. In this article, the technology consulting firm IDTechEx Research demonstrate how advances in semiconductor laser technology enable novel applications in laser material processing and industrial manufacturing.

The discussion herein is based on the recently published report “Laser Diodes & Direct Diode Lasers 2019-2029: Technologies, Markets & Forecasts”. In this report, IDTechEx Research analyst Dr Nilushi Wijeyasinghe presents a comprehensive review of diode laser technologies, value chains, key player activities and global markets. Recent progress in material processing is highlighted using case studies, where she draws on her background in laser physics and semiconductor physics research to explain new technical concepts. Segmented ten-year market forecasts and technology roadmaps are based on the extensive analysis of primary and secondary data, combined with careful consideration of market drivers and restraints.

Evolution of laser diodes and diode bars

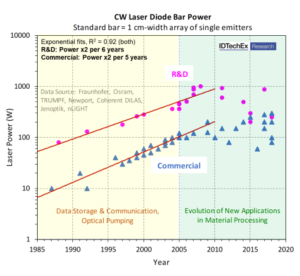

Technology advances have enabled lasers to progress from specialist technical instruments to a diverse range of markets. Laser diodes are the most widely available laser technology and are simple semiconductor devices. During the past three decades, the average power of laser diodes increased significantly, while their average price per watt decreased exponentially. Consequently, laser diodes are displacing some established laser and non-laser technologies, while enabling entirely novel optical technologies. Mature applications of laser diodes are data storage, data communication and the optical pumping of solid-state lasers. In contrast, material processing and optical sensing are examples of rapidly evolving market segments with many emerging applications. The output power of a single laser diode can range from milliwatt to multi-watt levels. Power can be scaled up by combining single emitters into laser diode bars and stacks of bars and a standard bar has a width of 1 cm. For decades, there was strong competition between companies to increase the output power of diode bars, and an exponential growth trend was observed. While commercial diode bar products usually offer power less than 200 W per diode bar at 1 micron wavelength, research and development (R&D) divisions of laser manufacturers have demonstrated continuous wave (CW) average power exceeding 1 kW per bar. Increase in diode bar power enabled new applications in material processing, but some emerging applications demand the enhancement of laser parameters like wavelength stability and device lifetime. Therefore, competing on power is no longer the priority for companies in this market. The ongoing evolution of diode laser technology includes the improvement of infrared beam quality for precision engineering and the development of novel visible light lasers for metal processing.

Power and precision: emerging direct diode laser technologies

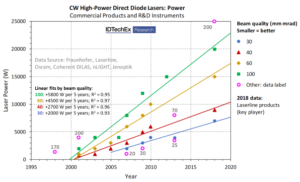

These incredible advances in semiconductor laser technology enable the development of direct diode lasers (DDLs), including high-power direct diode lasers (HPDDLs) that produce multi-kilowatt output power. DDLs combine numerous diode bars with beam shaping optics, control electronics and a cooling unit. Technology advances now enable DDLs to generate output power exceeding 20 kW in multi-mode systems and produce multi-kilowatt power at higher beam quality than before. In addition to DDLs, companies like Laserline (Germany) offer diode lasers coupled to active fiber converters, which produce 4-6 kW output power at an excellent beam quality of 4-6 mm mrad.

Dramatic improvements in beam quality now enable users to focus laser light to a small point, and this revealed DDLs as rapidly evolving tools for processing metal, plastic and composite materials. In applications like laser welding, which require high precision and deep penetration, DDLs can now compete with fiber lasers. While DDLs directly convert electricity to laser light, fiber lasers are based on rare-earth metal doped optical fibers, which must be optically pumped (energy input) via laser diodes or diode bars. The unit price of a DDL is significantly lower than a fiber laser for CW output power up to 1 kW. In 2018, the typical unit prices were $20,000 for a 1 kW HPDDL and $25,000 for a 1 kW fiber laser, as quoted by key player companies interviewed by IDTechEx. The difference in price between DDLs and fiber lasers is larger at sub-kilowatt output power. Additionally, the wavelengths offered by DDLs are different to fiber lasers, which means that DDLs can process materials with matching absorption spectra more efficiently. Consequently, DDLs and HPDDLs are emerging as major global trends in industrial manufacturing. In order to enhance their position in high-growth DDL/HPDDL markets, key player companies are making strategic acquisitions and investing into production capacity expansion. For example, Panasonic (Japan) acquired the laser company TeraDiode (USA) for their expertise in HPDDLs that generate high quality beams via a patented optical process. Overall, the technology advances outlined above provide excellent business growth opportunities. IDTechEx Research forecast the global market for laser diodes and direct diode lasers to reach a size of $14 billion by 2029, where direct diode lasers account for $2 billion. A detailed analysis of this market is presented in theIDTechEx Research report “Laser Diodes & Direct Diode Lasers 2019-2029: Technologies, Markets & Forecasts”.

Welding and 3D Printing Copper with Bright Blue Diode Lasers

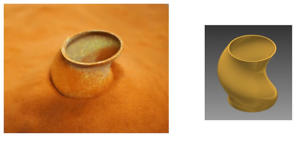

A particularly important trend is the development of blue direct diode lasers for applications like welding and 3D printing copper, with Laserline launching a 1 kW product in 2019. Blue laser light is faster and more efficient at processing metals that are poor absorbers of the 1 micron infrared radiation produced by most industrial laser systems. In 2018, Shimadzu (Japan) commercialised the BLUE IMPACT diode laser, which produces 100 W of power at high brightness. This product was developed in collaboration with Osaka University (Japan) as part of a Japanese national project. The BLUE IMPACT laser combines many gallium nitride (GaN) blue laser diodes by Nichia (Japan), which doubled in efficiency and increased by an order of magnitude in output power since 2006. A key application of Shimadzu’s 450 nm blue diode laser is in 3D printing copper. High absorption of blue laser light by copper enables a fast process with reduced back reflections, which are serious challenges for conventional infrared lasers. The newly developed 3D printer can efficiently print objects using pure copper powder. Existing 3D printer technologies typically use copper alloys like the CuCr1Zr instead of pure copper.